There’s a group of market participants that are starting to believe that the stock market is overvalued, specifically the S&P 500. This group believes that the stock market has been under pressure in the second half of 2023 because of high valuations and the unwillingness to bid prices too far above their “real value”.

However, the poor performance in Q3 and Q4 thus far has likely been due to expectations of interest rate cuts being pushed out to the summer 2024. This is likely what caused the reduction in stock market margin debt over the last 2 months as the smart money took some risk off the table.

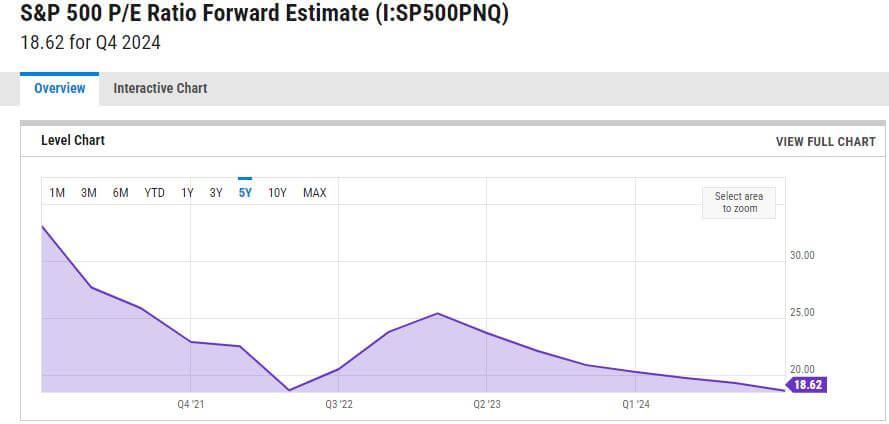

S&P 500 P/E Ratio Forward Estimate

If one were trying to gauge whether or not the market is expensive or not, they need not look further than the S&P 500 P/E ratio forward estimate. This ratio divides the current share price of a company by the estimated future (“forward”) earnings per share (EPS) of that company. For valuation purposes, this metric is viewed as being more significant than the current P/E ratio because it factors in what is expected in the future. Since stock markets are also forward looking and place greater emphasis on the future than the present, the S&P 500 P/E ratio forward estimate can typically work in harmony with the market itself.

As of right now, the S&P 500 P/E ratio forward estimate is showing a market P/E of 18.62 for Q4 2024 which is the lowest level of the last 4 years. This would indicate that markets are not overvalued in comparison to the last 4 years based on the expected growth in earnings of S&P 500 companies over the next 12 months. One also might expect an interest rate cut to supercharge these earnings over the next year. See the chart below: