Stock Splits Explained

The title of this article poses a great question and before we attempt to answer it, let’s start the definition of a stock split. A stock split increases the number of shares in a company; the split causes a decrease in the market price of individual shares, not causing a change in total market capitalization of the company, therefore stock dilution does not occur.

Stock splits are typically initiated after a large run up in the price of shares which leaves some market participants unable to purchase at the higher price. In effect, the stock split will reduce the price of the shares and allow more participants to purchase the shares which will increase the stock’s liquidity.

For example, assume “ABC Company” shares trade at $20 and within 10 months the shares rise up to $100/share. At this point there are many investors who can no longer afford to buy at $100/share so in order to increase liquidity and meet demand, “ABC Company” decides to issue a 2-for-1 stock split. In this scenario the company would double their number of shares which would reduce the share price from $100 to $50 ($100/2). Although the shares double the market capitalization remains the same as each investor who had 1 share at $100 would now have 2 shares at $50. The lower price would now allow more investors to continue to purchase shares.

Is this a buying opportunity?

In reality, a stock split shouldn’t matter for a company’s future returns. This is because there is nothing fundamental that changes about a company after a stock split, it simply just increases the liquidity of the stock. To help illustrate, we are going to analyze a full list of stock splits over the last 40 years.

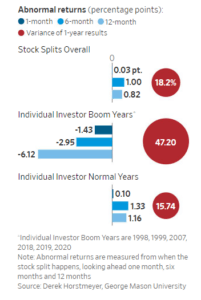

Overall, the stocks of companies that split their shares managed to outperform their benchmark over 6-months to a year. Stocks that split outperformed their benchmark by 1%, 6-months after the split, and by 0.82% 12-months after the split. However, there is one period when buying into a stock after it has split has provided negative returns, this is when there is high exuberance among individual investors. For example, in years when equity markets were in a rapid bull market, buying into a stock split cost investors an average of over -6%, 1-year after the split. Take a look at the data below:

The data suggests that market participants should buy into a split but only in years when the overall market is not advancing rapidly. However, participants should still do their due diligence on every stock they choose to buy, this data should not be the ultimate factor in an investment decision.