The Chicago Fed’s National Financial Conditions Index (NFCI) is an indicator that provides a weekly update on U.S. financial conditions in money markets, debt, equity markets, and traditional (and hidden) banking systems.

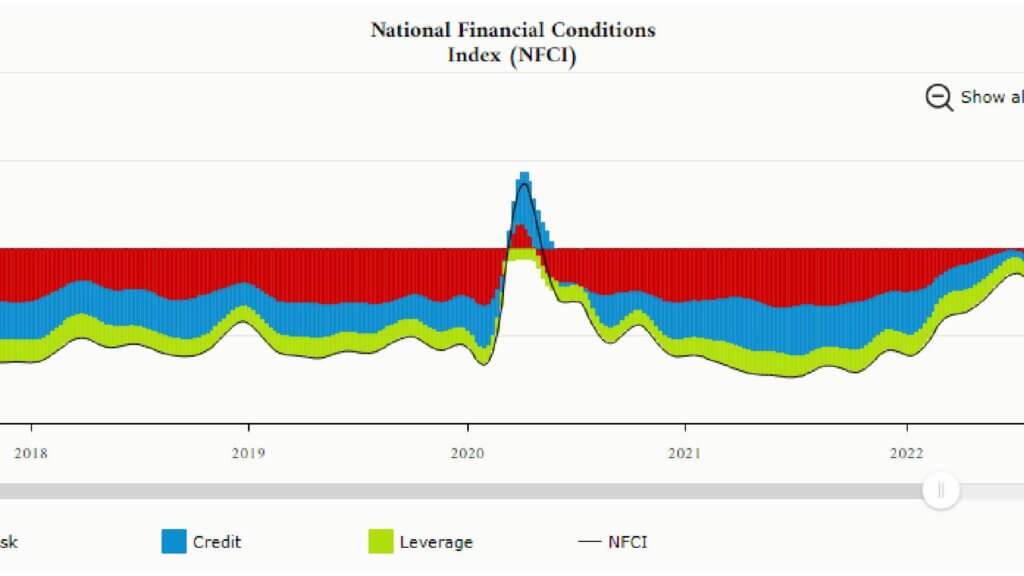

The NFCI is a weighted average of 105 measures of financial activity and they are each expressed relative to their sample averages and scaled by their sample standard deviations. The index indicates tight and/or loose financial conditions as measured across 3 major categories: risk, credit, and leverage.

When financial conditions are tight, economic growth tends to be slower (and vice versa). Furthermore, when financial conditions are loose, inflation tends to be higher (and vice versa). As of right now, the NFCI sits at -0.39 which is another leg down from the previous week (-0.37) as financial conditions continue to loosen despite higher interest rates. To put this into perspective, the NFCI was at -0.23 during the first week of January 2023 which shows that financial conditions have loosened slightly across risk, credit, and leverage indicators.

The NFCI can be used to indicate pivot points in financial markets because index scores above “0” (the average) have been historically associated with tighter-than-average financial conditions. In addition, index scores below “0” have been historically associated with looser-than-average financial conditions. If the NFCI should move above “0” we could be in for a bout of volatility because financial conditions are still looser than average. See below for a link to the Chicago Fed’s NFCI data.