The story of the commercial airline manufacturer duopoly shared by Airbus (EADSY) and Boeing (BA) is a long one but the fierce competition for customers has become a lot less fierce. As Boeing has capitulated over the years in one way or another (which we’ll get into later), airplane buyers have made the simple choice of choosing Airbus planes without even thinking twice. But long before that, this was quite a close race for control of the skies.

From 2007 to 2016 the two companies were near equal competitors, the only difference being that Boeing could charge more money for their airplanes. Over this time, Airbus received 9,985 orders to Boeing’s 8,978 but Airbus only delivered 5,644 while Boeing managed to dish out 5,718. The takeaway here should be that Boeing wasn’t capable of generating the same volume of orders as Airbus but made up for it with delivery speed (manufacturing speed).

The 2017 Airbus and Bombardier Partnership

Looking for a new way to compete with Boeing’s speed (which will later be identified as negligence), Airbus decided to join forces with Canadian global light rail and aerospace manufacturer Bombardier (BBD-B.TO). Bombardier had run into financial difficulties as the company bit off more than it could chew so to speak with cost overruns on its C-series aircraft. At the time this aircraft was meant to directly compete with Boeing’s 737 aircraft series, this was the first time the small Canadian company was getting into the mid size commercial airline business as it was previously focused on its Challenger and Learjet programs.

Financial issues aside, Bombardier’s C-series aircraft (now known as Airbus A-Series) was superior to Boeing 737s of the time. The base level C-series aircraft carried an equivalent amount of passengers as a Boeing 737 at the time and went further on less fuel. On that news Airbus was in for a 50.01% stake (and later buying out Bombardier in 2020) in the program which relieved Bombardier of financial stress during manufacturing.

With that being said the design is still credited to Bombardier as it had a few planes developed before the take over. Bombardier’s introduction of their C-series fleet is what prompted Boeing to start the 737 Max-8 program; and the partnership between Bombardier and Airbus is likely what prompted Boeing to start cutting corners so to speak.

A Close Race Until 2019

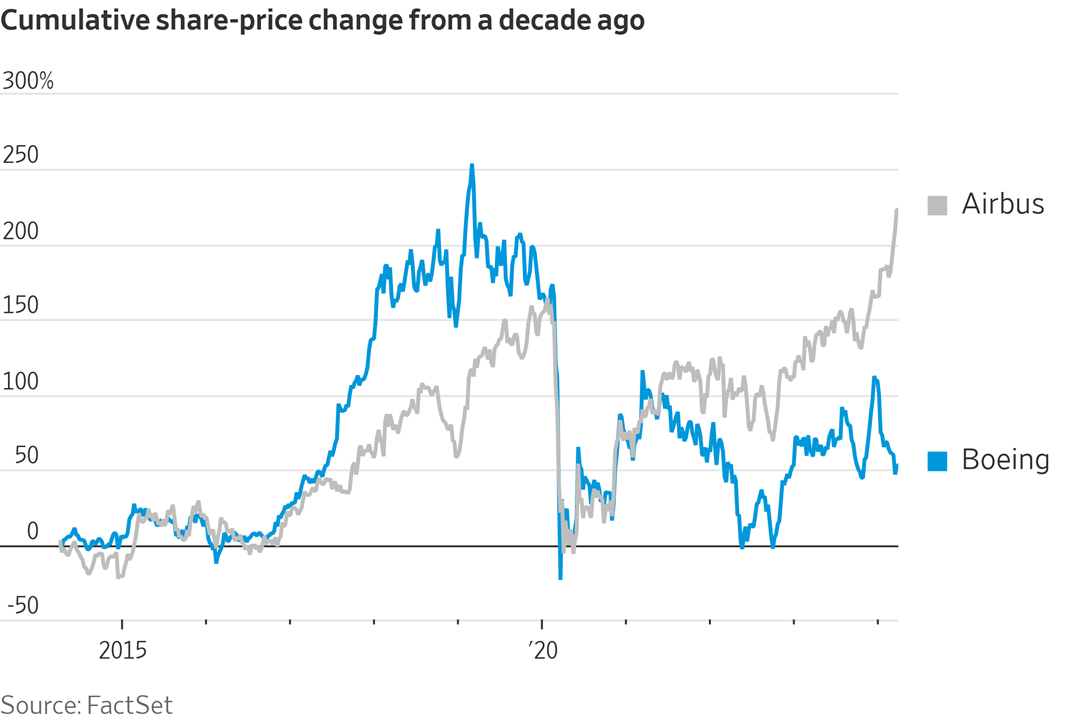

Even after the partnership between Airbus and Bombardier, the competition between Airbus and Boeing was still fierce. The C-series, soon to be Airbus A-series, airplanes were just reaching a steady manufacturing pace. So although Airbus had the better planes, there were few of them in the market. This all changed in 2019 when the Boeing 737-Max 8 aircraft was grounded worldwide following its second crash (stalling and falling from the sky) on March 10th, 2019 in Ethiopia. The first crash occurred less than 5 months earlier on October 29th, 2018 in Indonesia, the crash was similar in nature to the one in Ethiopia. By the end of 2019 and on the back of massive Boeing 737 Max-8 groundings, Airbus displaced Boeing as the largest aerospace company by revenue.

The Year 2023

A Brutal Start To 2024

Today, Airbus’ market share in the commercial aviation industry stands at a solid 60% and is steadily climbing higher every quarter. That shouldn’t be surprising as airline companies don’t exactly want their airplanes falling out of the sky or arriving with manufacturer defects or tools still on the plane upon delivery (oh yeah, that happens with Boeing planes too).

In addition, in January an Alaskan Airlines flight (Boeing 737 Max 9) had the rear door fly off mid flight causing panic among the crew and passengers, apparently Boeing forgot to bolt that on. This caused a grounding yet again, this time for Max-9 aircrafts, and a halt on an expansion of the Max program entirely as inspections were carried out by the FAA. The inspections found a plethora of loose door plugs on rear doors of 737 Max-9 aircraft at several U.S. airlines.

Fast forward to today and market participants can see that Boeing is a shell of the company it used to be. The CEO is stepping down shortly, its share prices are in disarray, and the company is reporting losses year-over-year. To make matters worse, there are calls to nationalize Boeing in every corner of society and of course the internet here and here. There is no place that Boeing can hide from their negligence but one thing is for sure, Airbus will be there to pick up every last piece of market share that it can.

Leave a Comment Cancel Reply

You must be logged in to post a comment.