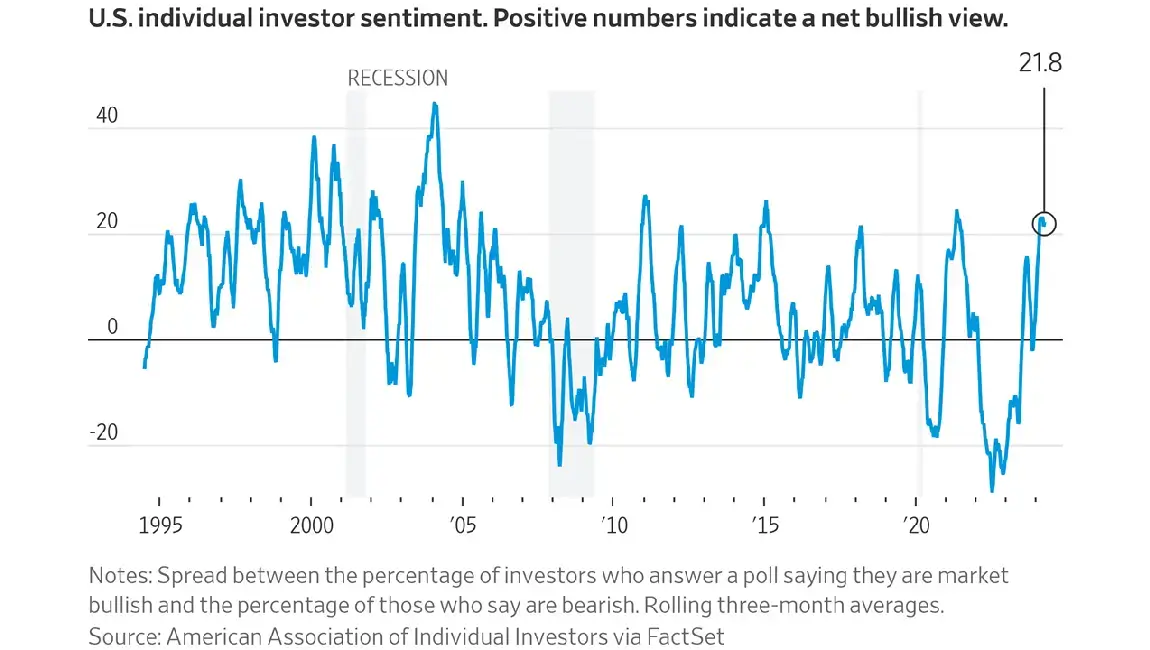

In trading, there are 3 main types of indicators that traders can use to assess financial markets and the overall economy. The 3 indicators by definition are as follows:

- Leading Indicators: A measurable set of data that might help to anticipate trends and forecast future economic activity. (Yield curves, housing starts, etc.)

- Coincident Indicators: Are indicators that usually change at the same time with general economic and/or market conditions. This is to say that coincident indicators reflect the current state. (Personal income, GDP, etc.)

- Lagging Indicators: Data that can only be known after a particular event has taken place, they are typically used to confirm a trend and/or pattern. (Unemployment and inflation rates, etc.)

Traders That Act As Leading Indicators

In addition, high profile traders taking positions in the market can also be viewed as leading indicators in certain types of markets, specifically a bull market. These types of traders have built up significant notoriety through successful stock and option positions and thus have been able to attract many followers to their positions, further inflating that position’s value. The good news is that stock positions (not derivatives) of these traders, and/or their thoughts, are usually available to the public. The top 3 traders can be seen below:

- Bill Ackman (Hedge fund manager)- Prospective strategy for market participants: Follow long.

- Nancy Pelosi (U.S. Member of Congress)- Prospective strategy for market participants: Follow long.

- Jim Cramer (Ex-hedge fund manager, TV personality)- Prospective strategy for market participants: Inverse.

Notable Positions

- Bill Ackman: Alphabet Inc. (GOOGL), Chipotle Mexican Grill (CMG).

- Nancy Pelosi: Nvidia Corporation (NVDA), Visa Inc. (V), and Alphabet Inc. (GOOGL).

- Jim Cramer: Long the tech bubble on February 29th, 2000, Long Bear Stearns in the financial crisis, Short Netflix (NFLX) in 2012. Complete stupidity on all of these.

Market participants looking to track the trades of hedge fund managers like Bill Ackman can start here. Those that are looking to track U.S. politicians like Nancy Pelosi can do so here for free. For tracking TV personalities like Jim Cramer, you could obviously watch him on TV or follow the inverse Twitter, more on that here.

Leave a Comment Cancel Reply

You must be logged in to post a comment.