The outlook for the Japanese Yen does look quite a bit brighter than it has over the last 5-10 years but markets shouldn’t expect gains to come all at once. The good news is that the Bank of Japan (BoJ) has ended its nearly two decade strategy of negative interest rates with its first interest rate hike in 17 years. Japanese interest rates moved up to 0.00%-0.10% at the BoJ’s March meeting which was widely expected by market participants, meaning it was likely priced in.

Furthermore, the BoJ announced that it would cease its purchases of ETFs in the open market and end its yield curve control regimen. It’s unclear if this is the end of stimulus or just the end of this type of stimulus as it looks for better ways to utilize capital in the economy. This decision came swiftly following salary negotiations between the largest trade union groups and corporations that resulted in 5.2%+ pay hikes for workers. This was the largest pay hike in more than 30 years and it will definitely contribute to economic growth and attract more workers to Japanese industries.

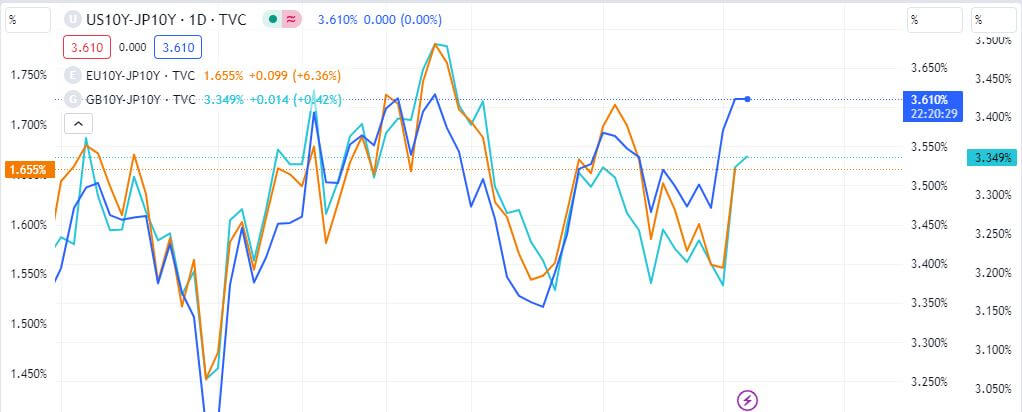

Bond Yield Differentials

A Demand For JPY As Funds Come Back Home

Over the last 17 years, an estimated trillion dollars worth of funds left Japan to seek higher yields overseas. Due to the negative rates that have plagued Japan for years, market participants sought greener pastures in other developed nations with higher interest rates and more developed markets to earn a return. Even with the currency hedging costs, the move still made sense for many Japanese corporations and accredited investors because capital always moves to a more hospitable location.

However, as mentioned above, Japan will likely be the only developed nation to increase interest rates twice in 2024. In the meantime all other global powers will be conducting rate cuts which could cause some Japanese funds to return home. Of course, all those dollars abroad won’t come back to Japan all at once because rates are still more advantageous elsewhere; but this could set the stage for a massive repatriation 5-10 years down the road. This repatriation would of course increase the demand for JPY as international currencies like the USD, EUR, and GBP get converted back to JPY and held in Japanese accounts.

USD/JPY, EUR/JPY, and GBP/JPY Forecasts

With that being said, here’s what markets could see by the end of 2024 in each specific currency pair:

- USD/JPY: 157 (USD gain)

- EUR/JPY: 162 (JPY gain)

- GBP/JPY: 188 (JPY gain)

Leave a Comment Cancel Reply

You must be logged in to post a comment.