Corporate earnings are on the rise as evidenced by the bulk of U.S. companies in the S&P 500 that have reported first quarter earnings. Earnings per share (EPS) for companies in the S&P 500 appear to be up 5.2% from a year prior which marks the strongest growth in nearly 2 years. At this point, calls for a recession seem to be a quite misguided as consumer spending has reinforced the bottom line at most companies.

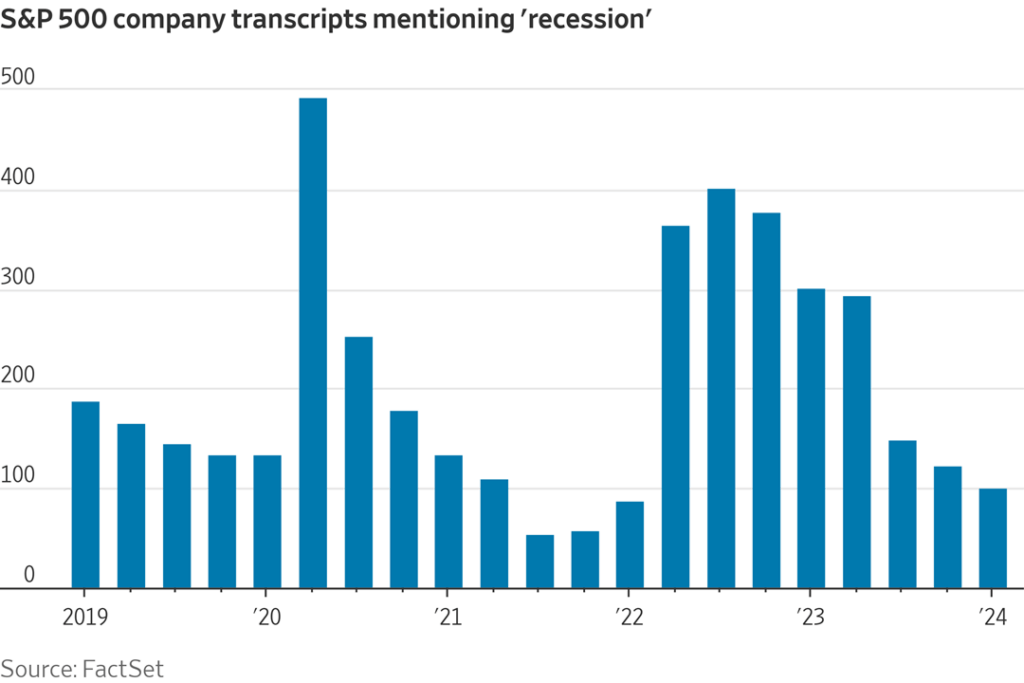

To be honest, according to company transcripts, the number of executives mentioning the word ‘recession’ has fallen to a near 2 year low. It’s not a coincidence that S&P 500 companies had the strongest EPS growth in nearly 2 years while the word ‘recession’ in a company transcript has fallen to a near 2 year low; these two events should and are going hand in hand. Moving forward we expect strong EPS growth to continue throughout the next 3 quarters in 2024 as had been forecasted in forward P/E ratio estimates.

Leave a Comment Cancel Reply

You must be logged in to post a comment.