All About PSHZF

Bill Ackman’s ‘PSHZF’ closed ended fund has made large gains over the last 2 months as the fund surged in November and December to finish 2023 with a 30%+ gain. The gain was good enough to beat the S&P 500’s gain of 24% as stocks rallied on interest rate cut expectations.

Pershing Square Holdings (PSHZF) is a closed ended fund that mirror’s Bill Ackman’s hedge fund, it has mostly traded at a discount to the hedge fund’s net asset value (NAV) due to Ackman’s previous management. However, ‘PSHZF’ has returned 222.78% over the last 5 years while the hedge fund itself has outperformed the S&P 500 by approximately 300% since inception on January 1st, 2004.

Closing The Gap

In June 2023, ‘PSHZF’ traded at a 37% discount to NAV but today it trades at a 26.5% discount to NAV (+10.5%) as it sits at $47.50/share. The fund is still carrying its 1.5% management fee and 16% performance fee when it performs above its high water mark (the highest historical NAV); and the fund is currently above that mark.

Looking Forward

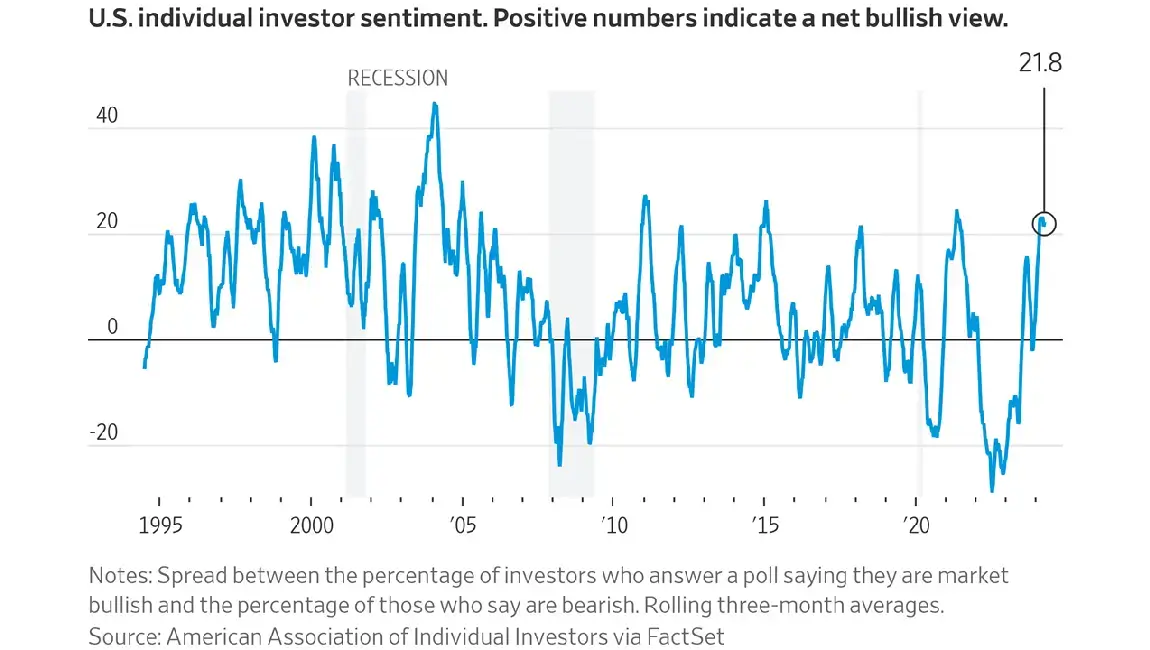

If 2024 comes as advertised with interest rate cuts, rising market margin debt, and a return to record profits for corporations, we could see a continuation of the bull market that arrived at the end of 2023. A broad based market rally could be great for ‘PSHZF’ to extend its gains over the S&P 500. Ackman will likely pick market winners and amplify the returns with margin power. Furthermore, as Pershing Square Holdings continues to buy back shares of its closed end fund, ‘PSHZF’, we could see the discount to NAV continue to close throughout 2024, providing gains to shareholders.

Leave a Comment Cancel Reply

You must be logged in to post a comment.