Gold price forecasts are running hot and unlike in recent history, gold prices are actually responding well to those very forecasts. Gold prices hit new all-time highs for nearly all major currencies in 2023 with the U.S. dollar being the last to climb aboard in 2024.

Gold All-Time High

Gold prices, in terms of U.S. dollars, hit a new all time high on Thursday as it hit $2,222.39/ounce. After reaching that new all-time high, in retrospect, it all seemed inevitable after gold hit all-time highs in the Euro, Pound, and Yen late late last year. But of course, we still had out doubts that gold could print the high in the world’s reserve currency (USD) because of intense market manipulation.

Fed Spotlight

Nevertheless, with the Fed in the spotlight, it seems like gold could extend its 2024 rally and even move above $2,300/ounce if interest rates fall in the second half of this year (and that is the current expectation). On Wednesday March 20th the Fed reiterated that it still expects 3 rate cuts in 2024 and they are likely to be seen in June (72% chance), September, and December (as of March 22).

When interest rates fall and interest bearing assets lose yield, gold should continue to rally but only if inflation remains persistent above the 2% mark (and how likely is that?). Should interest rates collapse and inflation follow suit, gold may experience a rapid sell off which would likely be indicative of a transition into equities. Lower interest rates should increase stock market margin debt which has always been a bull market signal for equities.

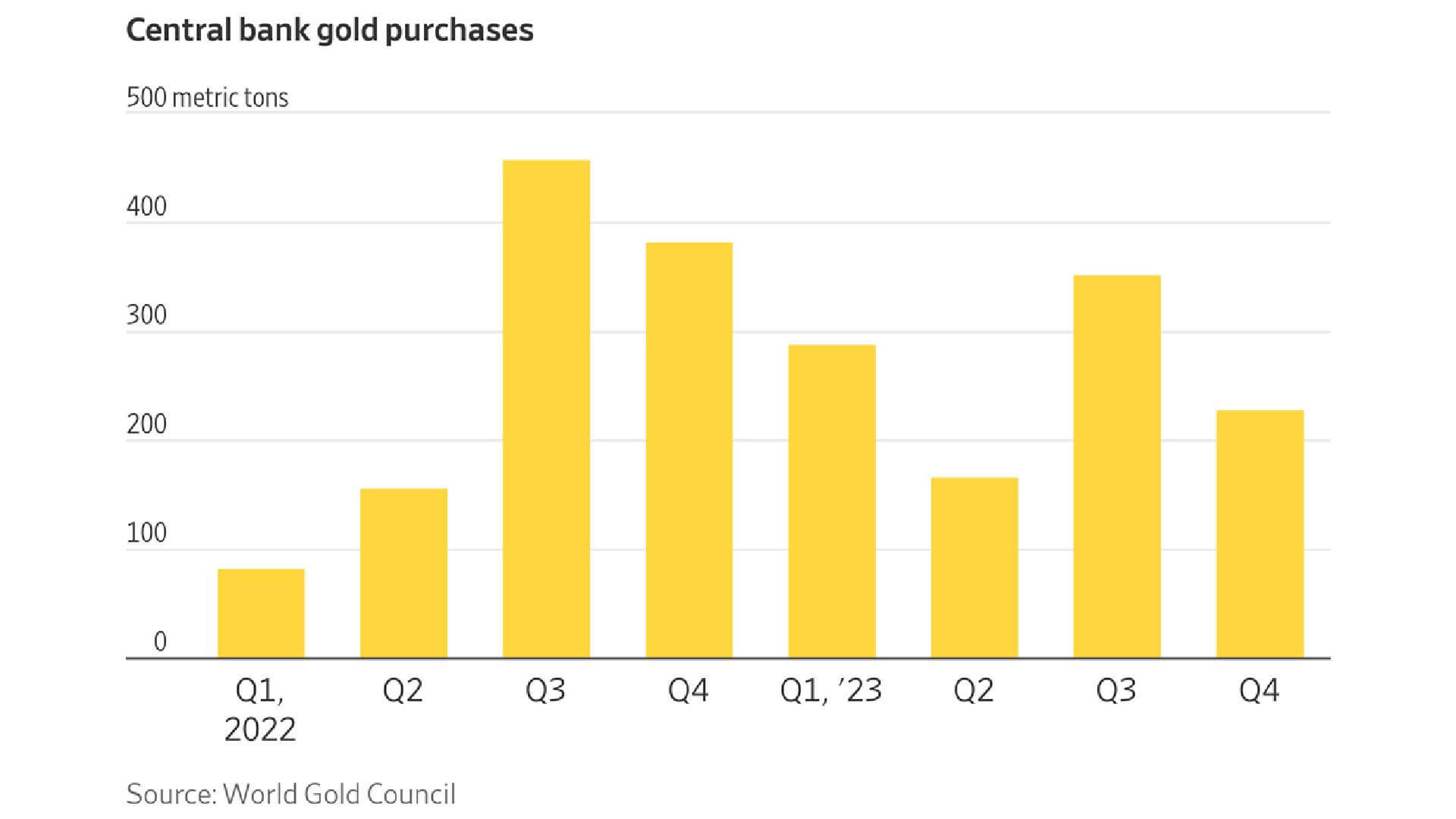

Physical Gold Demand

Leave a Comment Cancel Reply

You must be logged in to post a comment.