Instacart (CART) aka Maplebear Inc. provides online grocery shopping services to households in North America; to be honest, you probably already knew that. The company went public via IPO today at a price of $30/share which was good enough for a $9.9 billion valuation.

The IPO

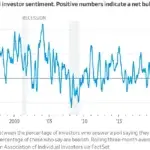

Shares rose 12.33% in today’s trading to finish at $33.70/share which was worth all the hype of an IPO that netted $660 million. There was strong demand from market participants throughout the day as shares were up 43% at their peak before settling down to a fair (or fairish) valuation.

The Company

Unlike UberEats, Instacart partners with several large grocery stores chains to achieve its economies of scale. Basically Instacart focuses on delivering groceries while UberEats focuses on delivering food from local restaurants. When Instacart partners with a grocery store, that grocer gets access to all the households (customers in need of groceries) on the Instacart platform. Customers can then order items from the store’s inventory, and an Instacart shopper will then pick up the items and deliver them to the customers doorstep. In addition, the grocer will typically pay Instacart a commission for each order placed through their platform as it drives foot traffic, and therefore revenue, for the grocer.

Tech Under The Hood

Somewhere In Between Palantir and Uber

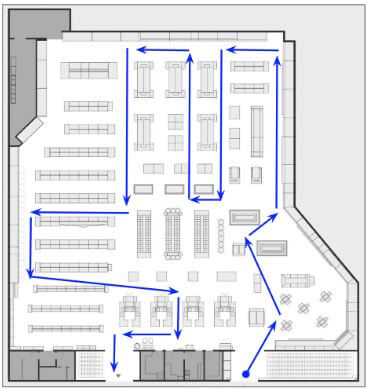

Instacart is data mining grocery stores, their customers, and their shoppers to create a matrix of grocery item trends, shopping/delivery times, and shopper experiences. Grocery stores have never met a technological offering like Instacart that is data mining (likely with AI) to enhance a shopper’s experience within their stores. Instacart’s databases and matrices are constantly growing as the needs of North American households change and grocery stores change. Every grocery store would be wise to partner with Instacart because the company’s insights could enable grocers to offer new products, services, or layouts to support their customers. Don’t be surprised if in the future you see one or more of the following:

- Instacart’s valuation inflate

- Instacart purchase a grocer

- Instacart become the leader in AI for retailers

2 thoughts on "Instacart: Nothing Like Uber"

Leave a Comment Cancel Reply

You must be logged in to post a comment.

I’ve never used Instacart but from the people I’ve talked to about it. They’ve said it helps them with their budgeting as well.

Great explanation but the stock price has taken a dip. Is this a good time to buy?