An Obsession

It all starts with an obsession with financial markets, it’s hard to be successful as a trader if you’re not waking up in the morning and looking for an edge. If that sounded ridiculous to you, you’ll likely end up being a much better investor than a trader. Investing can be quite easy, many market participants just buy an S&P 500 or Nasdaq 100 and call it a day. In that way, many feel there’s no need to look at the markets everyday, they simply just hook themselves up the index and play the long term averages (which are quite decent).

Trading vs. Investing

Trading itself is often a more active approach than the passiveness of investing but that’s not to say that one can’t do both. And it’s that active approach that leads to the obsession with markets; to know when to get in and out, or when to hedge, can be a portfolio saving opportunity that can even enhance returns. One of the best traders of all time and also a billionaire hedge fund manager, Paul Tudor Jones, once said “the secret to being successful from a trading perspective is to have an indefatigable and an undying and unquenchable thirst for information and knowledge “. More on Jones here and over here.

Actionable or To Be Actionable Information

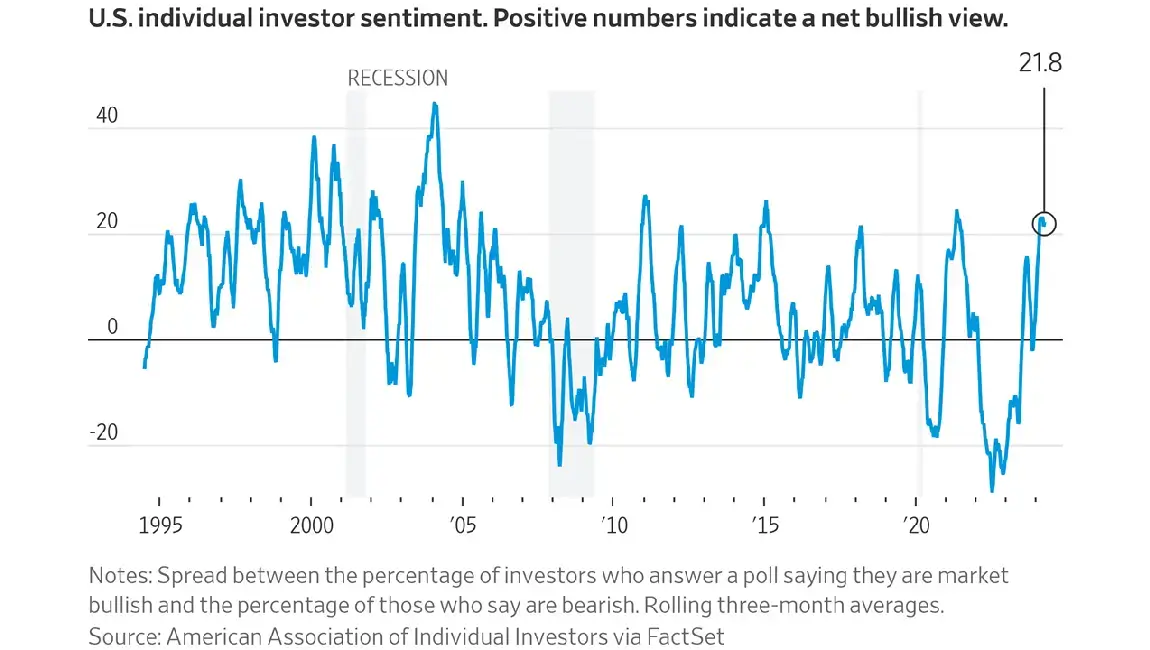

Often times traders fail due to an obsession with one’s self rather than an obsession with the financial markets in which one is looking to trade. As hard as it is to believe, if time in the market has taught us anything, the only reason for differences in returns among traders comes down to each trader’s willingness to acquire pertinent information. And that particular information must be information that market participants deem actionable (or will eventually deem actionable), rather than information that just you (one person) deems actionable. The reason for this is because once a market participant gathers information about a particular trade and takes a position, it’s now up to the market to catch on to that information and inflate that original market participant’s gains. In plain terms, once you take a position its up to the market whether you will make money or not.

A Set Up For Chapter 2

For the record, this is not to say that financial data is not important, or that charting is not important for that matter. This is just to say that it would be in one’s best interest to study each and every market in which one takes a position, to identify what information the market is deeming actionable (the macroeconomic theme) at that point in time. Markets change year-to-year and even within a year during major pivot points. The worst thing a trader can do is identify the wrong theme that is dominating a particular market, whether it be options, stocks commodities, or currencies. Let’s be honest, we’ve all been in a market and bought stocks with good financials only to see them sink to new lows, that’s because we had the wrong actionable information.

Leave a Comment Cancel Reply

You must be logged in to post a comment.